Welcome

TELEVISION AND RADIO, NOW AVAILABLE 24/7 Local and national podcasts

News, entertainment, television, radio, printing, and advertising agency helping you build your business brand is our goal.

News, entertainment, television, radio, printing, and advertising agency helping you build your business brand is our goal.

Check out this great video television news business printing advertising agency

The V Spot is just the right place for you and co-workers to meet for lunch, or unwind at Happy Hour and catch your favorite game on multiple screens.

Ladies are you ready to party with your favorite Girl, Dynasty? Well, don't play. We've got the hottest DJ's to keep you on the dance floor

You have been selected for 45 days of free advertising on Phoenix Street News TV. That's 180, 30-second commercials. Four ads pre day for 45 days.

Call Dynasty at 623-250-8652 to get the details of this offer. Hurry, this deal can't last.

Mention this ad for additional savings

Tantus is a small, mission-based sexual health company focused on manufacturing body safe products with unsurpassed quality for all. We believe in education, in activism, and in giving back to the community. We hope that our little company helps others to live healthier and happier lives!

At Phoenix Street News, we believe that great advertising starts with a deep understanding of our clients' businesses and their target audiences. We take a strategic approach to every project, and we work closely with our clients to develop creative solutions that resonate with their audiences.

We have a team of experts who specialize in different areas of advertising, including branding, graphic design, copywriting, digital marketing, and more. Our expertise allows us to deliver outstanding results for our clients, no matter the scope or complexity of the project.

We offer a comprehensive range of advertising services, including brand strategy, advertising campaigns, website design and development, social media marketing, and more. We work with clients across different industries and always strive to deliver exceptional results.

Be the first to hear about upcoming entertainment, new restaurants, and in general, what's going on in the valley. Special discounts, and hot fashion trends and let's not forget about your local MUSIC videos being played every Saturday Night with Radicalmike. DROP YOUR YOUTUBE MUSIC VIDEO LINKS

Phoenix Street News

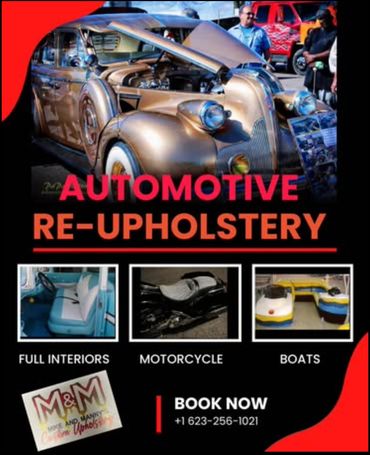

TV AND RADIO BY LOCAL PRODUCERS ARE NOW PLAYING ON THE HOME PAGE. 30-SECOND ADS FOR $1.50 EACH, AIRED FIVE TIMES PER-DAY. CALL 623-256-1021 NOW